child tax credit september 2021 delay

Some families who were expecting a child tax credit payment a week ago still have not received it. At 300 per month for children under 6 years old and 250 for kids up to 11 years old the dollars add up.

Stimulus Update Parents Frustrated By Delays And Issues Getting September S Child Tax Credit

You Might Be Able To Turn That Tax Bill Into A Refund.

. 3600 for children ages 5 and under at the end of 2021. KTLA Another round of advance child tax credit payments is just days away from going out to tens of millions of Americans. 1651 27 Sep 2021.

1151 ET Sep 27 2021. One parent with four children told KDKA that he really misses the. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

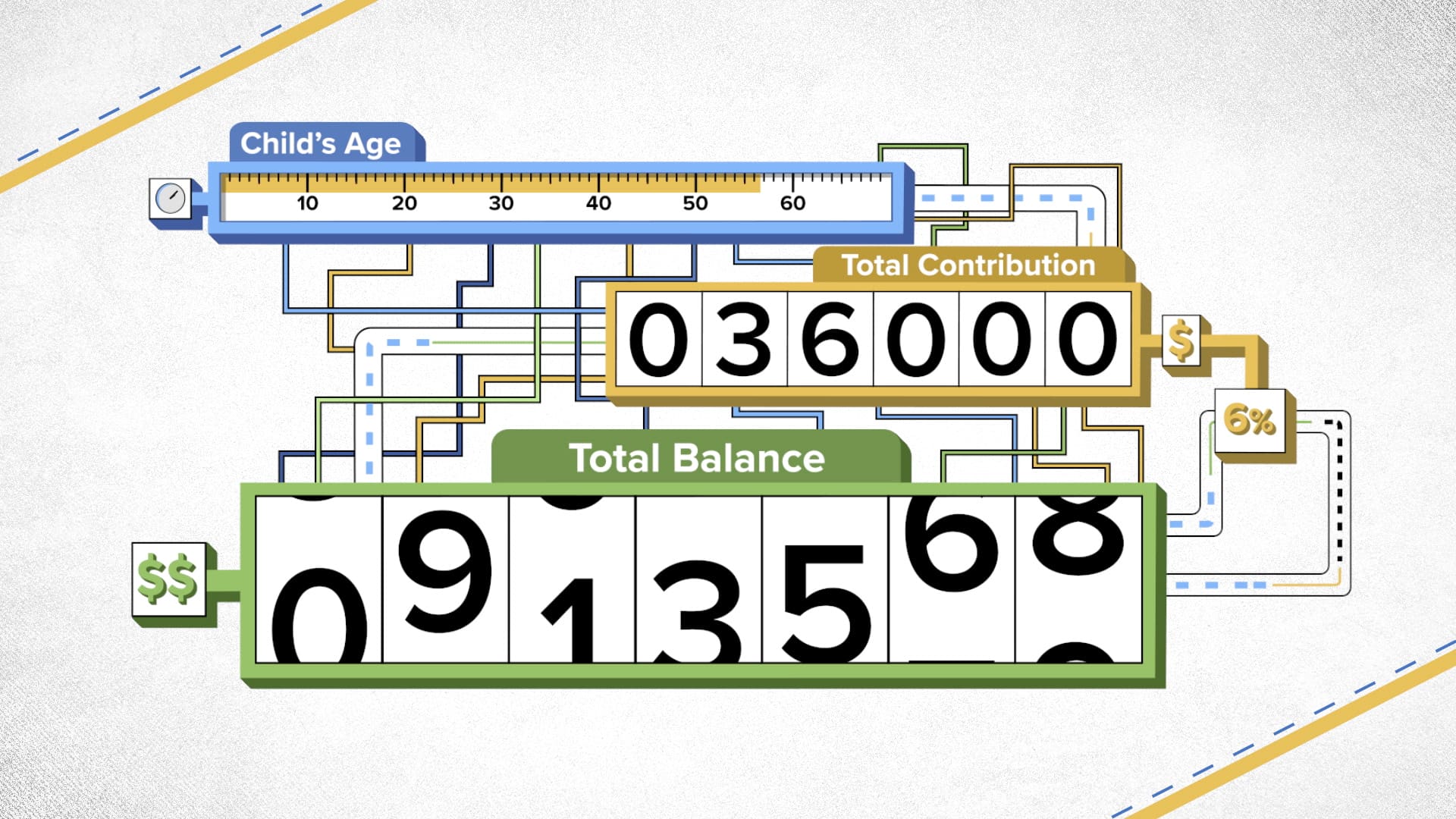

The March 2021 American Rescue Plan Act includes a credit of up to 3600 per year for children under age 6 and 3000 per year for children ages 6 to 17. FAMILIES who are claiming child tax credits may have to wait longer for a tax refund than they expect. An age test is applied as of Dec.

Similarly for each child age 6 to 16 its increased from 2000 to 3000. It also provides the 3000 credit for 17-year-olds. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. 31 would not qualify according to Mark Luscombe principal analyst for. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

SOME eligible parents are furious they are still. N the 15th day of each month families across the United States are supposed to receive advance payments of their 2021 child tax credit money. Under the American Rescue Plan the IRS.

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. September 26 2021 103 PM. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300.

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. Child Tax Credit wont be exempt from being paid back if you exceed the phase out unless you earn under 60k for married filing jointly. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

Some eligible parents who are missing their September child tax credit payments should get them soon. Delayed child tax credit payment leaves parents fuming but IRS promises you should get it soon. IR-2021-188 September 15 2021.

3000 for children ages. 31 2021 so a child who is 17 through most of 2021 but is 18 by Dec. In 2021 the child tax credits were temporarily boosted to 3600.

For each qualifying child age 5 and younger up to 1800 half the total. Half of the credit. It will also let parents take advantage of any increased.

This will allow new parents with a baby born in 2021 to take advantage of the tax credit payments they now qualify for. Eligible families can now apply for a one-time tax rebate to receive 250 for each child under age 18. Delayed child tax credit payment leaves parents fuming but IRS promises you should get it soon.

However many families are. The Child Tax Credit Update Portal is no. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are.

See what makes us different. Parents of a child who ages out of an age bracket are paid the lesser amount. Sep 13 2021 0808 AM EDT.

Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. The Internal Revenue Service.

The IRS is sending families the September installment of the 2021 Child Tax Credit on the 15th but how long will it be before it arrives in bank accounts. We dont make judgments or prescribe specific policies. 1119 ET Sep 27 2021.

That means if a five-year-old turns six in 2021 the parents will receive a total credit of 3000 for. Delay for economic impact payment but. CTC checks will continue to go out on the 15th of every month for the rest of 2021.

The rebate caps at 750 for three kids. Parents E-File to Get the Credits Deductions You Deserve. The September 15 checks were the third round of CTC payments and followed the first checks.

Latest Child Tax Credit Payment Delayed For Some Parents Cbs News

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

What To Know About September Child Tax Credit Payments Forbes Advisor

Canadian Tax News And Covid 19 Updates Archive

Child Tax Credit Delayed How To Track Your November Payment Marca

Canada S Child Benefit Boost Is Coming In May Here S How To Get It Rgb Accounting

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Irs Child Tax Credit 2021 Update Advance Payment Date For November Revealed And Opt Out Deadline You Must Act Before

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit Schedule 8812 H R Block

Child Tax Credit Dates 2021 Latest August 30 Deadline To Opt Out Of September Payments As Parents Flock To Irs Portal

Child Tax Credit Dates Next Payment Coming On October 15 Marca

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Time Is Running Out To Sign Up For Advance Child Tax Credit Checks

Canadian Tax News And Covid 19 Updates Archive

Stimulus Update Parents Frustrated By Delays And Issues Getting September S Child Tax Credit

Latest Child Tax Credit Payment Delayed For Some Parents Cbs News

Irs September Child Tax Credits On The Way For 35 Million Families Future Payment Dates Announced Whnt Com